Stillman Online

From around the corner to around the world, Stillman Online is the easiest way to bank! Follow the information below and you’ll be on your way to banking anywhere, anytime—24 hours a day, 7 days a week, 365 days a year. You can even access your account from your smartphone with Stillman Mobile!

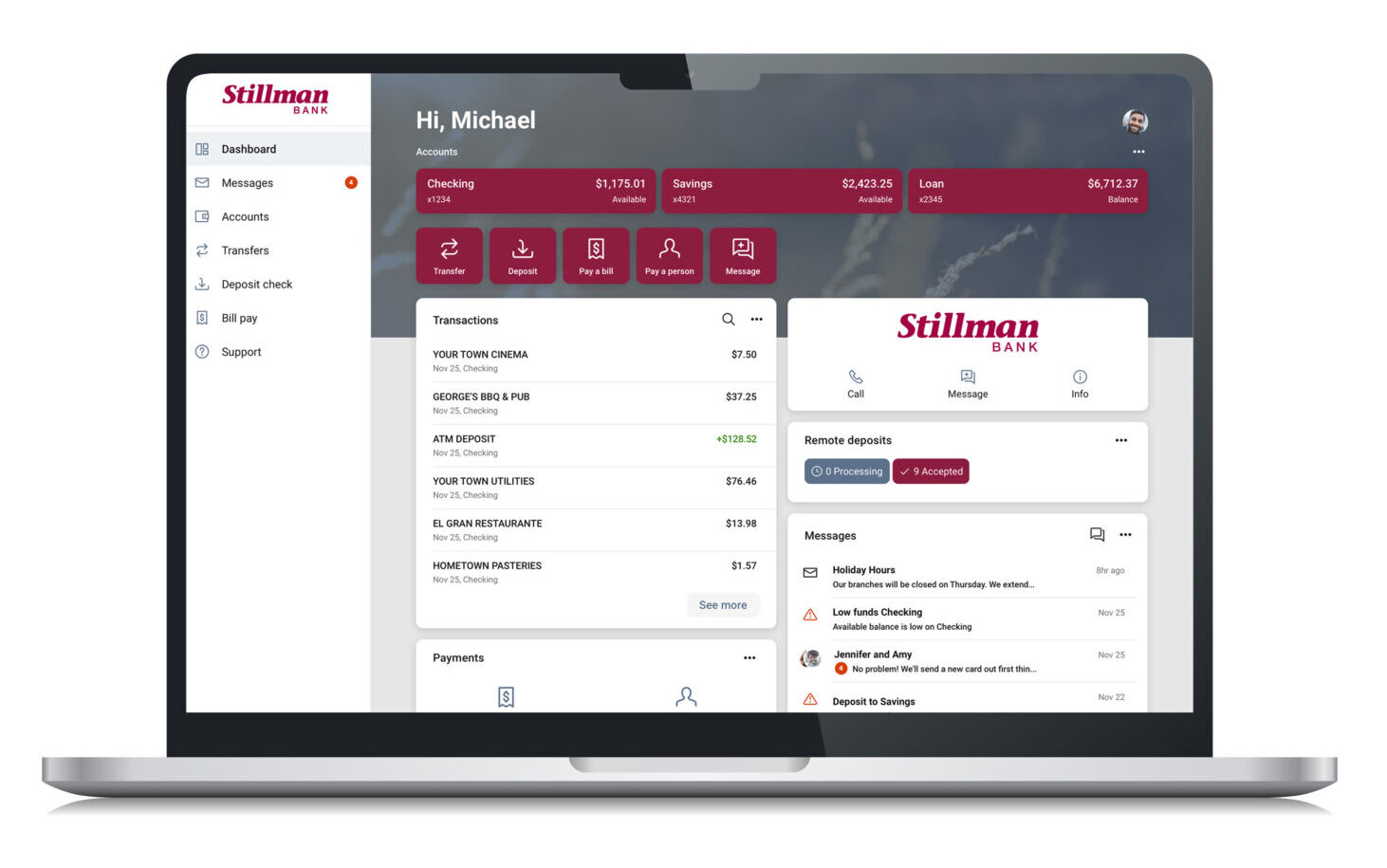

With Stillman Online, You Can:

- View images of your cleared checks and deposit slips

- View your account balances (including checking, savings, loans, line of credit, CDs, and IRAs.)

- Confirm deposits, withdrawals, checks cleared, and reconcile accounts

- Transfer funds (between your Stillman Bank deposit accounts and to make payments on your loans)

- View statement and account history (90 day history) in easy recognizable format

- Download account information into personal financial management software

- E-mail us directly with questions or support inquires

- Pay your bills online

*With Stillman Bill Pay, you will save on postage, envelopes, and most of all – time! There is no longer a need to hand-write checks or remember to pay bills on a particular day of the month

*Stillman Bill Pay is an optional service.

Online, Real-Time Information

Stillman Online operates on a “real-time” basis and is updated to reflect up-to-the-second account activity. For example, if you make a deposit at the teller line and go back home to access your account, your balance and account history will reflect the deposit.

Cost

For consumer account holders, Stillman Online and Stillman Bill Pay are FREE! (A separate application form and fee structure applies to businesses).

It’s Safe!

Stillman Bank is committed to the security and privacy of your financial information. Stillman Online is secure because multiple security procedures and technologies work together to create a safe environment for you to bank online. These protective features include:

- Security tools built into the Internet including firewalls and 128-bit encryption software, the highest level of security for your protection.

- Adherence to stringent industry standards. This includes the day-to-day security steps and procedures the bank follows to protect all of our customers.

- Two-factor authentication (2FA), which requires two forms of identification to gain access.

- You! All sensitive information requires passwords that only you know.

Because of this complex layer of security features, you can conduct transactions over the Internet with Stillman Bank safely and confidently. For your security, we also recommend that you utilize an up-to-date virus protection program.

Getting Started

In order to begin banking on Stillman Online, you must have a Stillman Online User ID and Password. To receive these, click here to get to the Online Banking Log-In screen, then click on “First time user? Enroll now” or click here. To continue the enrollment process, please proceed with the following steps:

- Review and agree to the Online Enrollment Agreement

- Enter the following information

- Social Security Number (EIN and ITIN are also accepted)

- An active account number

- E-mail address

- Phone number

- A one-time passcode will be sent to the email address on file. You must enter the code within 5 minutes or it will expire.

- You will be asked to choose your two-factor authentication (2FA) method. Once method has been chosen, you will be required to complete the verification process.

- Review and agree to the User Agreement

- After agreeing to the User Agreement, you will be asked to create your credentials (username and password) that will be used for all future logins.

Two-Factor Authentication (2FA)

In addition to the one-time passcode, we also require two-factor authentication (sometimes referred to as multi-factor authentication or MFA) to provide an added layer of security.

- Voice or text message to a landline or mobile device

- Authy - an authenticator app

- Authenticator app - our new platform supports any authenticator app using manual code entry

- If you login using a different web browser or login using a new or different device for the first time

- If you delete your browser history or cookies

- If you have your browser settings set to delete your cookies and history automatically

Questions? Need More Information?

To learn more about Stillman Online, please contact us.