Economic Outlook – Spring 2019 Edition

Hope Springs Eternal

The deep freeze of winter is finally over in the Midwest (we hope) and spring is in the air. There seems to be a renewed sense of optimism after a winter that dampened both moods and economic growth. The US Stock market rebounded from its big drop in the 4th quarter of 2018, with the S&P 500 index gaining 13.07% in the first three months of the year. The jobs report from March suggested that the dismal numbers reported in February (27,000) may have been an outlier. The private sector added 196,000 jobs for March which was more than consensus and even February was revised to 33,000.

GDP growth

In the 10 years following the Great Financial Crisis (GFC), Gross Domestic Product (GDP), a broad measure of economic activity, has only managed to grow an average of 2% per year. Many commentators believed that this figure should have been much higher as we rebounded from recession. However, in a book titled This Time Is Different, economists Kenneth Rogoff and Carmen Reinhart point out that recovering from a financial crisis can be long and arduous. First of all, it takes time to unwind all the debt that was built up – if you are paying down debt, you have less to spend on other things. Also, there are a lot of people who are living in homes that are worth less than they owe. These folks cannot as easily move to potential new job opportunities. This lack of mobility in the labor force also inhibits growth. Finally, workers who have been out of the labor pool for a long period of time can have trouble getting up to speed on new skills that would help them find new job opportunities.

Housing

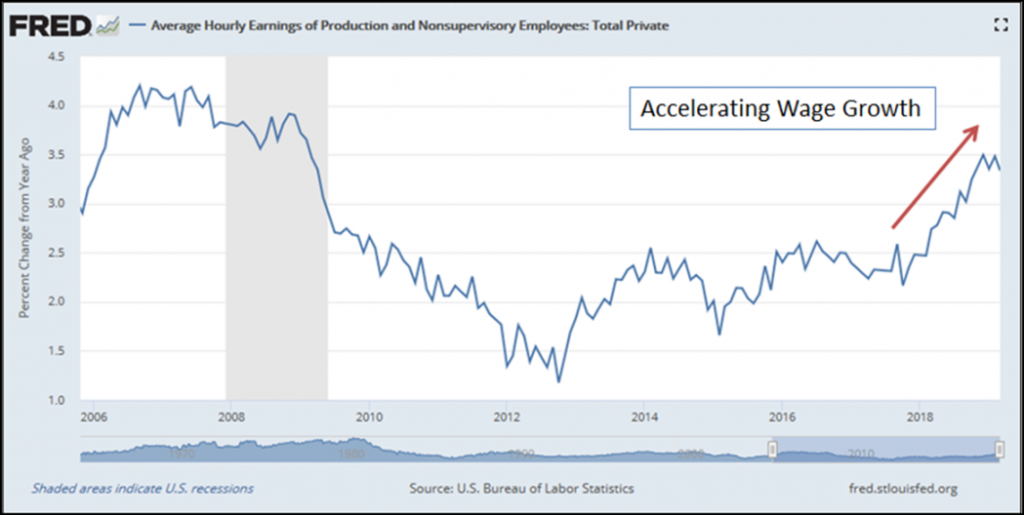

As I mentioned in the last Economic Update, (Economic Outlook – Winter 2019 Edition) the housing industry punches well above its weight in terms of economic impact. This is primarily because it affects so many other industries. People who buy houses also tend to fill those houses with other big-ticket items like furniture and appliances. Also, the people that build new homes get paid well and the more they work, the more they need to purchase new tools and new trucks to get to and from job sites. As we move into the second quarter of 2019, there are a few reasons to be optimistic about the housing market. First, wage growth has accelerated in the last 12 months. Potential home buyers are making more money.

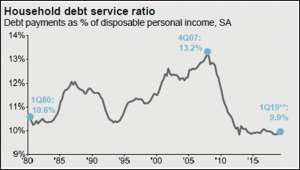

Household debt levels remain near generational lows. Potential home buyers are not as stretched as they used to be.

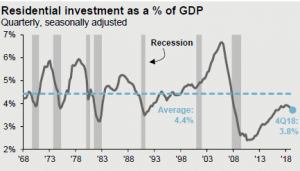

Residential investment is still well below the average of the last 50 years. Getting back to average would mean a substantial increase in dollars going towards housing.

Meanwhile, borrowing costs have dropped considerably since the fall of 2018. It is cheaper for potential buyers to get a loan than it was this time last year. With some pent-up demand from the harsh winter, that could bode well for activity.

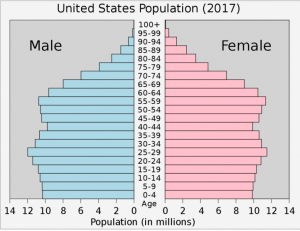

On a longer-term note, the largest block of the population, the Millennials, are getting into their late 20’s and early 30’s. More are getting married and having kids – which should translate into buying more houses.

This could explain the upturn in homeownership rates, which bottomed at 50-year lows in 2016.

The Bottom Line

While there is still reason to be cautious about today’s economic environment, housing could help keep the recovery going and potentially put it into a higher gear. There are plenty of well-known risk factors to this scenario, including the trade dispute with China and market reaction to monetary policy. However, our position is that continued growth is the most likely outcome.

Demographic data, specifically millennials reaching late 20’s to mid-30’s, suggests that household formation should accelerate over the next few years. This is a positive sign for the housing market. With interest rates so low, now may be the best time for some young families to buy their first home.

With the housing market as a potential driver of further economic growth and the Fed on pause with any additional rate hikes for the near future, we believe odds for a recession have fallen. If the market continues to move higher we will look at rebalancing our portfolios back to our benchmark levels. This is something we have done a few times in the past 6 months.

For instance, at the end of September 2018, the market reached all-time highs. The stocks in our clients’ portfolios appreciated in value as a result and became a larger percentage of the overall allocation (So that a portfolio designed to be 50% stocks and 50% bonds became more like 55% stocks and 45% bonds). By rebalancing, we sold the stocks that appreciated to get the stock allocation back to target levels.

The next three months the market declined by over 13%, taking our stock allocation below target levels. So we bought stocks at the end of December to get back on target. Finally, to start 2019 the market has rebounded sharply. This has offered another opportunity to rebalance. This time we sold most, but not all, of the overweight in stocks. This disciplined practice of buying low and selling high has benefitted our clients and we continue to adhere to that policy. The extent and timing of rebalancing is informed by our views on economic conditions.

As always, please contact us if you have any questions. We look forward to hearing from you.

Keith J. Akre, CFA, CFP® – Trust Officer

Opinions expressed are solely my own and do not express the views or opinions of Stillman Bank. Investments available through Stillman Trust & Asset Management (1) are not FDIC insured (2) are not deposits, obligations, or guaranteed by the bank and (3) are subject to investment risk including possible loss of principal.