Economic Outlook – Spring 2021

“The Economic Engine has Room to Run but Risks Remain”

As spring has taken hold, economic data continues to paint a picture of recovery. After a hard winter of increased Covid cases and slow business activity, the last couple of months have shown a marked improvement. The question now is whether or not this recovery can continue throughout the rest of the year. We believe it can, though there are certainly risks to that outlook.

The vaccine roll-out has gained pace and now 25% of the US adult population is fully vaccinated with those numbers steadily increasing. As vaccinations increase and the US gets closer to “herd immunity” – where enough people are resistant to the virus to not allow it to spread – restrictions will ease, and people will begin spending again on things like travel, entertainment, and dining out.

This growth case is also supported by the record amounts of government stimulus that have been delivered to businesses and consumers. There is also a proposed infrastructure bill that could add a couple trillion dollars into the economy via building projects and other government spending. The past three Presidents have each talked about infrastructure but have not been able to get it passed by Congress. While this current proposal has broad-based support in theory, it still faces many roadblocks before it can get passed.

The biggest risk remains the Covid variants that are popping up. If one or more prove more resistant to the vaccine than has been reported so far, that could put a quick halt to the current expansion.

Here are the economic stats we are looking at to assess the economy and financial markets through the rest of 2021.

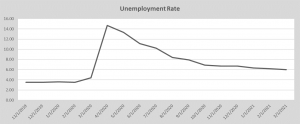

Labor Market Tightening

The official unemployment numbers continue to lower from their peak one year ago. This trend is expected to continue as restrictions ease and more businesses expand operations.

Furthermore, the anecdotal observations continue to indicate that the labor market is even tighter than the numbers report. Many employers are reporting having a hard time finding workers to fill roles. Here in Rockford, help-wanted signs can be seen in many places. The restaurants that are open, even at 25-50% capacity, have signs showing that they are short-staffed. Linda Duessel of Federated Hermes observed in a recent weekly post that “A McDonald’s franchiser in Florida is paying people $50 just to show up for a job interview.” One manufacturing company I work with said that they have started paying out $1,000 bonuses for people who stay for 90 days.

In sum, people are reporting that good help is hard to find. My thought is that this trend is likely to keep pressure on inflation as wages will need to increase to attract and retain workers. Good help can always be found – for the right price.

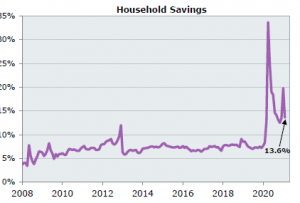

Savings Rate

Many of us have experienced some level of cabin fever and are anxious to get back out in the world. It appears that with more people finding jobs and pressure on wages to go up, consumers will have the financial means to go out and spend. Today, savings rates are still at historically high levels, it is likely that spending will pick up assuming savings rates return to normal levels.

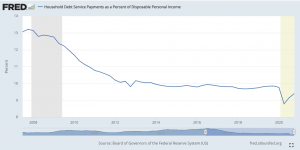

Debt

Households have also been paying down debt on a steady basis since the financial crisis of 2008. This combined with decreasing interest rates has meant that Debt Service Payments as a percent of income are at multi-decade lows. This suggests that households have the capacity to extend themselves a little if needed.

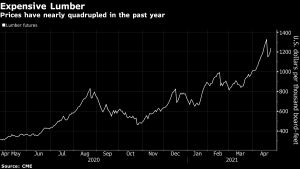

Inflation

As mentioned above we may see some upward pressure on inflation as businesses need to pay more to attract workers and pass that additional expense along to a consumer who appears to have some room to absorb those increases. We are already seeing rising prices in commodities, with lumber prices being the major headline in that space.

These higher lumber prices have been showing up in the cost of new home construction. And, with existing homes still in short supply, the overall home price index could continue higher for some time.

Modest inflation in the economy is actually a good thing as it could push demand forward. That means that if people are expecting prices to go up, they may accelerate buying decisions on certain things. If you think a car will be more expensive in 6 months, you may elect to take a good deal now.

Risk Factors

The most pressing risk to any growth scenario remains a resurgence of Covid to the point of having to enact further lockdowns. While vaccinations have shown to be effective against variations of the virus so far, if one were to emerge that proved resistant to vaccine, it could put a quick halt to the economic recovery. Not to mention it would be terribly deflating to a population that is eager to be on the other side of this long pandemic.

Another risk to growth is inflation. If prices were to rise much faster than they are now, instead of boosting activity, the Fed would have to seriously consider taking steps to slow inflation (equivalent to putting cold water on the economy). In the last 10 years, financial markets have reacted poorly to the Fed even hinting at taking away liquidity. For example, the “Taper Tantrum” occurred when the Fed suggested they would start reducing or “tapering” bond purchases and volatility in the market increased as a result.

Inflation is not to the point of being worrisome – yet. However, there is a risk that it gets too hot and that could be trouble for the economy and financial markets.

The Bottom Line

We are optimistic about the economy for 2021 and also optimistic that financial markets can continue their positive performance for the year. Valuations are historically high right now as a result of the strong price appreciation we have seen in the last 3 years, dampening our enthusiasm somewhat. As in most historical bull market runs, this one can last until something unforeseen comes along and derails it. The coronavirus pandemic certainly disrupted it last year, but the ensuing government response, in the form of stimulus payments and rescue packages, brought the economy and markets back on track. There is certainly a concern that all this government spending could cause problems down the road but we can’t say when, or even if, those concerns will ever manifest.

We will continue to monitor the situation and update our views as necessary. Please let us know if you have any questions. We look forward to hearing from you!

Best wishes from your friends in the Stillman Bank Trust and Wealth Management Department.

Keith J. Akre, CFA, CFP® – Vice President & Trust Officer

Opinions expressed are solely my own and do not express the views or opinions of Stillman Bank. Investments available through Stillman Trust & Wealth Management (1) are not FDIC insured (2) are not deposits, obligations, or guaranteed by the bank and (3) are subject to investment risk including possible loss of principal.