Economic Outlook – Winter 2022 | “Heating Up or Cooling Down”

Happy New Year! 2022 has started off with temperatures in many parts of the country dropping below zero and financial market volatility heating up. My hope is that this trend reverses and we begin to see the weather heating up and financial market swings cool down.

Last year ended with a continued increase in both inflation and COVID Cases. Prices were rising not just in spite of COVID, but in some cases, because of it. Supply chain issues were caused by so many people missing work due to COVID and some businesses were paying higher prices to get the goods they needed and get them on time.

Inflation

Currently, inflation is at its hottest level since the 1980s. The Federal Reserve has indicated they will begin raising interest rates in March to help combat this rising inflation. The concern that the Fed will mishandle this transition from declining to rising interest rates has led to some of the market volatility we have seen so far this year.

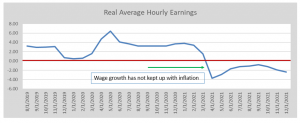

Labor and Wages

Economic growth was higher than expected for the 4th quarter of 2021, coming in at 6.9% versus forecasts of 5.5%. So far, companies have been able to pass higher input costs onto consumers in the form of higher prices. It will be important to see if that trend continues because, for the last nine months, wages have not kept up with overall inflation. This means that people’s paychecks are not growing as fast as their bills are. This is normal because companies are hesitant to raise wages too fast because once you increase wages.

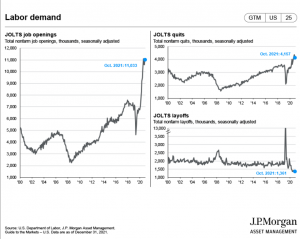

There is evidence that wages could start catching up with broader inflation. If you look at these charts from the JP Morgan Guide to the Markets, it shows that the labor market is getting very tight. Companies have a huge number of openings they are trying to fill, while more people are quitting their jobs, and most of those are for higher-paying jobs elsewhere.

Housing

All this turnover in the labor market could also lend support to an already hot housing market. Home prices have been increasing the last two years and it’s a question whether that will continue in 2022. On one hand, companies looking for workers may have to recruit outside their normal geographic area and sweeten the pot by helping pay moving costs and add bonuses for housing, etc. On the other hand, the ability for more workers to be able to work from home means they may not have to move at all. And if interest rates begin to rise, it would likely mean higher mortgage rates as well which could cool the housing market.

Bottom Line

The economy appears to still be heating up but still a long way from over-heating. Inflation has been increasing but it’s not at dangerous levels. The Fed has reiterated its commitment to “price stability” and has signaled an increase in rates starting in March. Workers have the most bargaining power they have had in a long time and consumers are still buying despite increases in prices. Our take is that unless there is an external shock to the system, the economy will remain strong.

However, what this means for financial markets is more difficult to say. If the economy runs strong and company earnings continue to do well, we could see stocks recover their upward momentum. On the other hand, if earnings start faltering while inflation continues to run hot, and the Fed has to act more aggressively than they have been forecasting, market volatility could remain high and we could see a correction. As always, we are watching developments closely and have been adjusting portfolios in case of either scenario.

Whether things are heating up or cooling down, we are here to help navigate. Thank you for reading and please reach out if you have any questions.

Keith J. Akre, CFA, CFP® – Vice President & Trust Officer

Opinions expressed are solely my own and do not express the views or opinions of Stillman Bank. Investments available through Stillman Trust & Wealth Management (1) are not FDIC insured (2) are not deposits, obligations, or guaranteed by the bank and (3) are subject to investment risk including possible loss of principal.