Look Back With Gratitude and Ahead With Caution – 2018 Outlook

In terms of risk-adjusted returns, 2017 was one of the best years on record. The S&P 500 index gave investors a return of more than 20% with historically low levels of volatility. We are certainly grateful for the gains we have seen, especially since we know they do not come around all that often. Now it is time to train our eyes to the future.

Does Past Performance Predict Future Results?

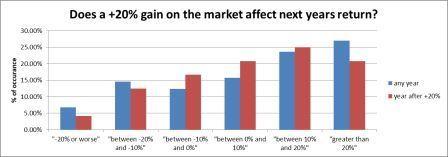

What does the performance in 2017 tell us about what we can expect in 2018? Unfortunately, not much. Over the last 90 years, the market has gone up by more than 20% 24 times. When we look at what happens the year after, no clear pattern emerges. The average return on the market following an up 20% year is 6.52%, compared to the average return over the past 90 years of 7.47% – slightly lower. So again, I would argue that the market going higher does not, in itself, tell us much about what will happen the following year.

In fact, if we break out the performance into 10% increments, we can see that the distribution of returns after an up 20% year is very similar to what it is in any given year. The degree of similarity is actually a little surprising given how small the sample size is. The outliers are 1937 where stocks fell 38.6% after going up 27.92% in 1936, and the late 1990’s where the market was up more than 20% four consecutive years starting in 1995.

Where to Look Next?

Since looking back at past performance is not helpful in determining where the market may go in the future (no surprise there) we turn to some of the fundamentals of the economy and markets to help us in our outlook. The following areas are points of importance we will be monitoring into the New Year and may be cause for adjustment in our asset allocation.

Wage Growth and Inflation

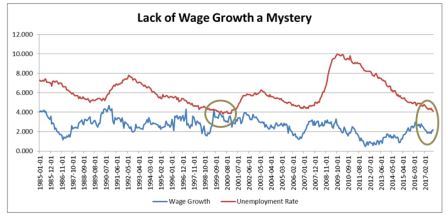

One of the enduring mysteries of the economy has been the apparent lack of wage growth despite increasing reports of a labor shortage. Recently there was a story in the Wall Street Journal about a lack of snowplow drivers in Maine1. However, despite numerous anecdotal stories of the same nature (bus driver shortage in Oregon, and lack of teachers in Colorado), the published numbers for national growth in wages continues to come in at very modest levels2.

Will 2018 be the year wage growth begins to show the tightening of the labor market? Will companies begin to compete for talent more aggressively, thereby sending wages higher? I think it is likely we see wage growth begin to reach the 3% level and possibly higher. If this does indeed occur, I believe the economy will continue to improve as consumer spending should improve more than enough to offset the increased costs to employers.

Interest Rates

The topic of wage growth then leads us to consider where interest rates will be throughout 2018. Wage growth is a leading component of inflation, which the Fed eyes carefully in determining the level of short-term rates. Bond investors have been nervous for years about the risk of interest rates climbing too fast, thereby reducing the value of their fixed-rate investments. When interest rates are 2%, your bond’s 3% coupon is relatively pretty good; however, if interest rates move up to 4%, that same 3% is not as attractive.

So the risk of rising interest rates carries a couple of components – how far they go and how fast they get there.

There are a couple different scenarios that could play out. The first, and I believe more likely scenario is that interest rates will rise gradually over the year. This gradual rise will allow bond investors time to have old fixed investments mature, and will then reinvest the principal at higher rates. Stocks and bonds can both do well in this environment.

The second scenario, which is still entirely possible, is that wage growth and inflation begin to accelerate faster than economists anticipate. In this case, the bond market could send interest rates higher at a pretty rapid clip. As mentioned above, this environment could be very dangerous for both stocks and bonds. Bondholders would see the values of their bonds drop as the market sells in order to reinvest at higher rates, and those new rates would provide heavier competition to an already expensive stock market.

Corporate Earnings

One of the primary drivers of stock prices is the expectation of companies being able to grow earnings into the future. Three of the factors which may drive earnings in 2018 (global economic growth, job numbers, and consumer confidence) still appear to be offering good news for investors.

The first bit of good news on the corporate side is the passage of tax legislation. This bill will likely lower the tax burden on most companies (some significantly) which will lead to an immediate gain to the bottom line. We are already starting to see some reaction from companies on this front as AT&T recently announced a $1,000 bonus to all employees upon passing of this bill.

The overall economic environment appears to be positive for companies as well. While wage growth is still very modest compared to the overall unemployment rate (as shown above), the fact is that more people have jobs and wages are increasing, even if it is at a moderate pace. Combine this with strong consumer confidence numbers from the University of Michigan’s Survey of Consumer Sentiment3, and healthy household finances4, and the consumer could be a positive force for earnings throughout 2018. A good indication of the healthy, confident consumer showed up in this year’s holiday shopping season. According to Mastercard, holiday shopping sales grew almost 5% from last year; the most since 20115.

Conclusion

As we continue to exercise our fiduciary duty of growing and protecting the wealth of our clients, we train a careful eye on what 2018 may have in store for financial markets. While the economic data suggests that stock prices could continue to move higher, there is always a risk of negative surprises. That is why we exercise a disciplined practice of rebalancing portfolios and carefully monitoring risk exposures.

Where many investors get into trouble is that after a year like this, instead of being grateful and remaining disciplined, they get greedy and assume greater risk. These investors look smart when the going is good, but will often get washed out when the correction comes. So while we think 2018 is likely to be another positive year for the market, we are monitoring risks to that outlook. We will continue to work hard to give you the peace of mind to concentrate on the things that matter most to you.

If you have any questions, or would just like to talk about the markets and investing, please contact me.

Have a bright and prosperous New Year,

Keith J. Akre, CFA, CFP® – Trust Officer

Opinions expressed are solely my own and do not express the views or opinions of Stillman Bank. Investments available through Stillman Trust & Asset Management (1) are not FDIC insured (2) are not deposits, obligations, or guaranteed by the bank and (3) are subject to investment risk including possible loss of principal.

Sources:

1. Wall Street Journal – https://www.wsj.com/articles/in-maine-snow-is-everywhere-but-not-snowplow-drivers-1514203200

2. Louis Federal Reserve FRED database – https://fred.stlouisfed.org/series/LCEAMN01USM659S

3. University of Michigan – http://www.sca.isr.umich.edu/

4. Louis Federal Reserve FRED database – https://fred.stlouisfed.org/series/TDSP

5. https://www.axios.com/2017s-holiday-shopping-season-was-the-biggest-ever-2520308398.html