What To Do in a Declining Market

The year 2022 has been off to a rough start for investors. No matter where you turn, with a few notable exceptions, market values have been on the decline. Through May, stock prices, as measured by the S&P 500 index are down 12.76%, while bonds, as measured by the Bloomberg Aggregate Index, have declined by 8.5% year-to-date.

It is at times like these, when the market is down, that investors run the risk of deviating from their financial plan and jeopardize falling short of their goals. Here are some general tips on dealing with market corrections. Obviously, before making any investment changes, speak with your advisor. If that is one of the relationship managers at Stillman Bank, we look forward to hearing from you.

- Do not panic – prepare

The hard thing about markets with declining prices is that you don’t know when they will stop declining. While you should not make any sudden reactionary moves it does not mean you should sit on your hands and do nothing. The best thing to do is to look at your short-term cash needs and make sure you have cash on hand to cover them. You should look out three years for anything you are expecting over and above operational expenses. If you find your cash reserve to be a little light, go ahead and add to it. If the market recovers and you missed some of it because you put a little towards cash, at least you know you have strengthened your financial position. If markets continue to decline you will know you have your cash needs taken care of for three years and won’t have to sell assets at depressed prices.

- Revisit the Plan

It can be helpful to go over your long-term financial plan to confirm that everything is still on track. Done right, a financial plan will have taken into account periods of volatility. Call your advisor and ask them to update your plan. It can be helpful to be reminded that market declines are normal and you will not have to alter your lifestyle regardless of what happens in the market.

- Think Opportunistically

If you have a long-time horizon, say 10-20 years, a market correction can be a good time to put some additional funds to work. If your cash reserve has grown to be more than adequate, you could consider investing some of it. If you are still working you could think about increasing your retirement contributions while prices are lower. Again, any decisions should be made with advice from a financial professional regarding your specific situation.

- Don’t try to be too smart

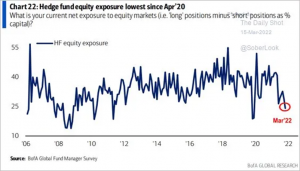

Some investors think they will just sell and wait for the market to bottom, and then buy back in once the coast is clear. The problem with that approach is that it is near impossible to do in practice. There are no signs that say “the coast is clear”. Markets hit the bottom at points of maximum fear and pessimism. Even the so-called “smart-money” has a hard time figuring it out. The chart below shows the amount of money hedge-funds as a group had allocated to the stock market over time. They had their lowest allocation to stocks in March of ’09 and April ’20 – both times when markets hit bottom!

- Know Thyself

Investors don’t know how they will handle volatility in financial markets until they go through it. When that time comes, they may find they do not have as much of an appetite as they expected. Seeing markets drop can cause some anxiety. People begin to doubt their financial plan and wonder “will I have any money left?”

The bottom line is that if your health is starting to be affected, you have to turn down your risk, even if it is not the ‘financially correct” decision according to your financial plan. The generic advisor line to “stay the course” is not helpful in those situations.

The important thing is to remember that risk is like a dial, that can be turned up and turned down. Risk management is NOT a switch to select Risk ON or Risk OFF. So you should not think of being IN or OUT, but if you feel you need to do something for your well-being, talk to your financial advisor, and ask them what it would look like to turn the risk dial down a bit. You may find that you feel better by just talking through it.

Too many times investors get nervous and decide to sell out at the very bottom. Then they have to worry about when to get back in and end up losing out on a large part of the recovery.

The bottom line is that market corrections are normal. The ups and downs of a free market economy of stocks is the cost you have to be willing to pay for larger average returns over time. Remember that there is no more solid law of investing than the one that says in order to get greater returns, you have to take more risk.

Regarding the current correction, we cannot say how deep or how long it will go. Given the current environment, we expect that we are closer to the bottom than we are to the top, however it is a very volatile time and events can happen that change the outlook quickly. Our goal is to make sure that our clients can reach their financial goals regardless of what happens in the market.

If you have any questions, please call one of our relationship managers.

Contact Our Trust Department

Keith J. Akre, CFA, CFP® – Vice President & Trust Officer

Opinions expressed are solely my own and do not express the views or opinions of Stillman Bank. Investments available through Stillman Trust & Wealth Management (1) are not FDIC insured (2) are not deposits, obligations, or guaranteed by the bank and (3) are subject to investment risk including possible loss of principal.