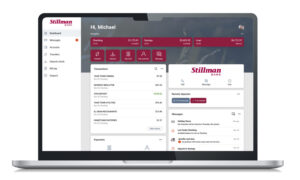

Our Digital Banking Suite (Online Banking, Mobile App, and Bill Pay) has been upgraded to a more simple, seamless, and secure platform. Your satisfaction is our top priority, and this upgrade is designed to deliver an improved online banking experience and make managing your finances even more convenient.

What To Expect

This upgrade creates a more modern, consistent look and feel across all your devices and simplifies how you manage your accounts and move money. So, no matter where you are or what device you want to use, you can:

- View balances: Quickly check your account from anywhere.

- Manage transactions: Search your recent activity, filter by tags, even add an image or note to an entry.

- Transfer funds: Initiate one-time, future date, or repeating transfers. Also, you have the ability to do bank-to-bank transfers.

- Personalize your experience: Arrange features in a way that makes the most sense to you – customize the interface on a per-device basis and move things around however you like.

- Get alerts: Receive push notifications and alerts to stay in the know.

- And MUCH more!

Online Banking & Bill Pay

In addition to the above perks, Stillman Bill Pay is now integrated into our online banking platform. This allows you to log in to our Online Banking & Bill Pay platform with just a single sign-on. With Stillman Bill Pay, you can quickly and easily set up bill payments and pay bills to virtually anyone, anytime, anywhere.

- On Monday, February 12, our Bill Pay system will go offline and will not be active again until Monday, February 19.

- Scheduled payments will still occur that week but all payments must be scheduled prior to Monday, February 12 as the system will be in the process of upgrade/enhancement and unavailable until Monday, February 19.

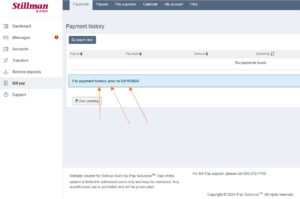

- Current payee and account information, scheduled/recurring payments, and payment history should transfer over to the new platform after the conversion. However, we recommend you print out your payment history in the event some information does not transfer over correctly.

- Bill Pay will now be integrated into our Online Banking platform. This allows you to log into our Online Banking & Bill Pay platform with just a single sign-on!

- Verify that your payee names, addresses, and account numbers are correct. This will help avoid disruptions to your scheduled payments.

- Set up new eBills for your payees. With eBill, you can view, pay, and track bills online. If you had eBills set up prior to this enhancement you will need to re-enroll them to reactivate your eBill status.

- Try the "Pay a Person" feature. It lets you send money to anyone with just a few clicks!

Learn more about this exciting upgrade!

View a quick demo to see how to pay a bill, set up Bill Pay alerts, and more!

When you are logged in to Bill Pay, to view your payment history, click on the “For payment history prior to 02/19/2024” text, as illustrated below.

Your username and password for Online Banking and Bill Pay will stay the same. If you don’t remember your login credentials, give us a call.

Mobile App

As of February 19, you will need to download our new app. Search “Stillman Bank” in the App Store or Google Play Store to download the new version of our mobile banking app. Once you have the new app downloaded, please delete the old Stillman Bank Mobile Banking app to avoid any confusion. If you attempt to use the old version of our app, you will be redirected to the new one.

The updated Stillman Bank app includes an impressive list of convenient features that you are going to love!

- Biometrics or PIN authentication: Easily and securely log in using your fingerprint, face, or a personal identification number.

- View balances and account activity: Search for transactions, add a note or an image, and filter by tags. Understand your activity and find what you’re looking for – fast.

- Make deposits with a snap of your camera: Deposit checks into qualified accounts using your mobile deposit feature.

- Bill Pay: Pay bills quickly and securely.

- Transfer funds: Effortlessly initiate one-time, future date, or repeating transfers. Also, you have the ability to do bank-to-bank transfers.

- Personalize your app: Arrange the app’s features in a way that makes the most sense to you – customize the app on a per-device basis and move things around however you like.

- Office and ATM locations: Find the nearest Stillman Bank ATM or locate an office using your current location.

Your username and password for mobile banking will stay the same. You’ll need to log in with this information before you can use features like Touch ID or Face ID. If you don’t remember your login credentials, give us a call.

First-Time Access | One-Time Passcode

You will use your current Stillman Bank Online Banking username and password to log in to the new platform. If you are currently using biometrics (fingerprint/Face ID) to access your mobile app, please make sure you take note of your username and password as you will be required to manually enter it to log in.

After you put in your username and password, a one-time passcode will be sent to either the phone number or email address on file to confirm your identity. The verification code will need to be entered within 5 minutes of receiving it in order to move on to the next step.

Note: You are only required to enter a verification code the first time you log in on a specific device or internet browser. An option is given in this step to opt out of the one-time passcode for the device or browser you are using. If you choose to access your account via multiple devices or a different internet browser, the one-time passcode step will need to be completed each time.

Two-Factor Authentication (2FA)

In addition to the one-time passcode, we are also adding two-factor authentication (sometimes referred to as multi-factor authentication or MFA) to provide an added layer of security.

- Voice or text message to a landline or mobile device

- Authy - an authenticator app

- Authenticator app - our new platform supports any authenticator app using manual code entry

- If you login using a different web browser or login using a new or different device for the first time

- If you delete your browser history or cookies

- If you have your browser settings set to delete your cookies and history automatically

Upon completion of two-factor authentication, if you are using our mobile app, you will be asked to also create a four-digit PIN for your device. This will be used instead of your online banking username and password going forward. Once the passcode has been established, you will have the opportunity to turn on biometrics (fingerprint/Face ID) if your device has the capability. Once enabled, you will log in using biometrics with your four-digit PIN serving as a backup password in the event biometrics fails to work.

TeleBank

Our TeleBank system has also been upgraded. Please carefully read and retain this important information to ensure that you can continue accessing your accounts by phone.

- Our TeleBank number has not changed with this transition. To access the system, you will still dial (815) 645-2000 or (815) 332-8844.

- To verify your identity, the first time you call in, you’ll need to enter your account number followed by your Social Security Number. This is the only time you will be asked to enter your Social Security Number. You will then be prompted to re-register your Personal Identification Number (PIN). For account transactions and inquiries (balances, interest, etc.), you will always be asked to enter your account number and PIN.